Complex Mergers and Acquisitions:

Few matters are more complex or have greater importance to our business clients than mergers and acquisitions. AMM attorneys are experienced in developing and implementing creative strategies to position our clients, helping to maximize value whether they are a buyer, a seller, a lender, or an intermediary. Our attorneys are highly skilled deal makers with the knowledge and insight to guide you through the twists and turns and complexity of a high stakes business merger or acquisition.

Working closely with businesses of all sizes, from small entrepreneurial companies to mature entities, our team crafts custom solutions for every facet of your transaction. We take the time to understand your strategic objectives and bring years of practical business savvy to bear to ensure that the finance, tax, employment and intellectual property requirements of your deal are aligned to achieve your goals.

Our seasoned business attorneys regularly provide counsel in planning, structuring, negotiating, and consummating a varied range of relationships and transactions including:

• Transaction structuring

• Negotiating and preparing non-disclosure agreements and letters of intent

• Due diligence

• Negotiation of financing documents

• Negotiation and development of definitive agreements

• Assistance with post-closing matters, including earn-out, working capital, escrow, and seller financing issues

Our business clients know that their attorney is a dedicated partner who understands their needs, goals, and the stakes involved in this meaningful phase of the life cycle and evolution of their businesses.

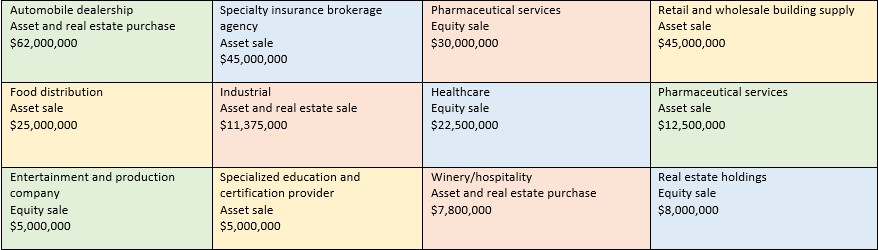

Representative Deals: