For more information about our Business & Finance services, contact:

- Lisa A. Bothwell

- Janel Clause

- Susan A. Maslow

- Michael W. Mills

- Joanne M. Murray

- Peter J. Smith

- Stephen M. Zaffuto

As companies grow, so does their need to manage financial, legal and operational challenges. Creating sustainable growth requires hard work, planning and a sound stragety, this is where AMM's business team can help.

Our business clients range from high-growth, early-stage companies and regional community banks to mature, closely-held manufacturing and licensing enterprises, as well as service companies and health care providers. We create long-term relationships with our clients as they rely on our integrity, capabilities and responsiveness to their questions and concerns. Our legal team anticipates the needs of clients as those needs evolve over the life cycle of the business.

Our Practice Focus:

- Mergers & Acquisitions

- Business Divorce

- Contract/Drafting & Review

- Corporate Governance

- Corporate Record Keeping

- Entity Formation

- Financing

- Private Placement of Securities

- Software & Saas Licensing Agreements

- Employment, Shareholder, Partnership & LLC Operating Agreements

- Real Estate Purchases & Leases

- Succession Planning

- Executive Compensation, Including Equity Compensation & Alternatives

Industries Served:

- Manufacturing & Industrial

- Professional Service Providers, Including Accounting, Legal, Engineering,

Medical & Financial Advisory Services - Biotech & Pharma

- Technology/Software

- Real Estate Developers

- Nonprofit Organizations

- Restaurants & Hospitality

- Healthcare Providers

Banking law covers a wide variety of topics relating to the regulation of banks, bank officials, and non-bank institutions that offer bank services. Antheil Maslow & MacMinn’s Business & Finance Practice Group attorneys understand the challenges financial institutions face on a daily basis.

From simple loan documents to complex land development deals, Antheil, Maslow & MacMinn attorneys help in balancing the need to make intelligent lending decisions with the desire to establish and maintain strong customer relationships. We understand the needs of a company and the requirements of lenders, bringing a depth of experience to the legal needs of the Greater Philadelphia area including Bucks County and Montgomery County for the following services:

- Documentation for loan workouts, receiverships, assignments, restructuring/reorganizations, repossessions, bankruptcies and foreclosures

- Negotiable instruments (e.g., bill of exchange, promissory note)

- Commercial asset-based and unsecured financing

- Real estate secured and unsecured financing

- Construction financing

- Commercial leasing

- Sales of loan and lease portfolios

- Creditor’s rights

- Defense of Fair Credit Reporting Act claims

- Defense of lender liability claims

- Defense of Fair Debt Collection Practices Act claims

Starting a business can be an exciting and challenging time. There are complex legal issues to take into consideration, but the rewards are often worth the trouble. The Corporate practice group at Antheil Maslow & MacMinn, LLP understands that it is important to construct a solid foundation as you begin to build your business enterprise, and there are fundamental decisions that a business owner must make.

To make your business’s start easier, better organized, and more cost effective, our practice offers new small business owners bundled entity formation services which include the following:

1. Formation Documents – Our office will prepare and file the appropriate formation

documents for your new business, including:

a. Corporations: Articles of Incorporation, Bylaws, Stock Certificates, Waiver Agreement and preparation of

legal publications*

b. LLCs: Certificates of Organization, Operating Agreement

2. Tax – Our office will ensure that your new business has filed and made the appropriate tax

filings and elections at the direction of your accountant:

a. SS4/EIN application

b. S-Election/Check-the-box

3. Our office will provide you with a detailed instruction letter along with the organizational

documents to make sure that you and your business do not have a rough start.

Fee Structure:

Fixed Fee for Corporations of $1,000 (includes all filing fees & minute book)*

Fixed Fee for LLCs of $750 (includes all filing fees & minute book)

*Legal publication fees are not included.

Antheil Maslow & MacMinn attorneys devise strategies to ensure compliance with local, state and federal tax laws by monitoring changing tax regulations, interpreting new developments, and staying ahead of any issues that might arise for clients in the Greater Philadelphia area including Bucks County and Montgomery County.

Almost every business decision carries tax implications. The emphasis of our Tax Law Practice Group is not on just "doing the deal," but making sure the deal is structured most advantageously from an income and estate tax standpoint. We provide a full range of services for tax planning, consulting, and legal representation in the following areas:

- Analysis of new tax laws and regulatory impact

- Structuring and planning for acquisitions and dispositions of businesses

- Executive compensation, including stock options

- Tax planning for real estate purchases, exchanges, or sales

- Buy-sell and other succession agreements for businesses

- Sophisticated tax planning strategies for disposition of publicly-traded stocks

- Advanced pension and retirement strategies

- Advice regarding structure of new ventures

- Quarterly and year-end tax planning

- Detailed projections which permit analysis of different planning options

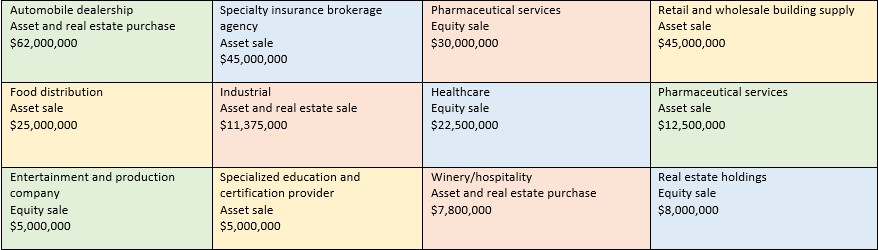

Complex Mergers and Acquisitions:

Few matters are more complex or have greater importance to our business clients than mergers and acquisitions. AMM attorneys are experienced in developing and implementing creative strategies to position our clients, helping to maximize value whether they are a buyer, a seller, a lender, or an intermediary. Our attorneys are highly skilled deal makers with the knowledge and insight to guide you through the twists and turns and complexity of a high stakes business merger or acquisition.

Working closely with businesses of all sizes, from small entrepreneurial companies to mature entities, our team crafts custom solutions for every facet of your transaction. We take the time to understand your strategic objectives and bring years of practical business savvy to bear to ensure that the finance, tax, employment and intellectual property requirements of your deal are aligned to achieve your goals.

Our seasoned business attorneys regularly provide counsel in planning, structuring, negotiating, and consummating a varied range of relationships and transactions including:

• Transaction structuring

• Negotiating and preparing non-disclosure agreements and letters of intent

• Due diligence

• Negotiation of financing documents

• Negotiation and development of definitive agreements

• Assistance with post-closing matters, including earn-out, working capital, escrow, and seller financing issues

Our business clients know that their attorney is a dedicated partner who understands their needs, goals, and the stakes involved in this meaningful phase of the life cycle and evolution of their businesses.

Representative Deals:

Computer technology, software and systems are vital to businesses of all sizes. Antheil Maslow & MacMinn attorneys have extensive experience representing software vendors, computer consultants and other provider-side parties of the technology equation, as well as customers in the industry. We are also familiar with the unique issues facing software developers, including the use of open source software and trade secret protection.

From negotiating and drafting contracts for development through complex litigation relating to failed software and systems development projects, our Business & Finance Practice Group helps clients in the Greater Philadelphia area including Bucks County and Montgomery County reap the advantages of regulations, policies and the commercial environment affecting the way they do business. Our work includes drafting and reviewing all types of technology-related contracts, including:

- Non-disclosure Agreements

- License Agreements

- Support and Maintenance Contracts

- Consulting Work for Hire Agreements

- Joint Development and Marketing Relationships

- Website Development Agreements

- Source Code Escrow Arrangements