They Are Here: Beneficial Ownership Reporting Requirements for Small Businesses Go Into Effect January 1, 2024

Last year, we warned you in our business law blog that a new law, the federal Corporate Transparency Act, would be going into effect that would require many businesses to provide information about their owners and anyone who controls the company to the federal government. We now know that this law will take effect on January 1, 2024. Reporting companies in existence prior to that date have until January 1, 2025 to comply; companies formed on or after that date must comply within 30 days after formation. Once the data has been entered, companies are obligated to update any information that becomes outdated or is incorrect. The information will be included in a database that will be used to combat money laundering, financing of terrorism, and other illegal activities.

Coming Soon: Beneficial Ownership Reporting Requirements for Small Businesses

On January 1, 2021, Congress enacted the Federal Corporate Transparency Act (the “CTA”), pursuant to which a secure database will be established to assist law enforcement agencies in combatting money laundering, financing of terrorism, and other illegal activities. The objective of the CTA is to prevent bad actors from using shell companies to obscure the provenance of their ill-gotten gains.

The database will be administered by the Financial Crimes Enforcement Network (“FinCEN”), an agency of the U.S. Department of Treasury. Companies will be required to provide information relating to their beneficial owners (generally, individuals owning 25% or more) and persons who are in control (generally, individuals holding significant decision-making authority). There are exceptions, such as publicly traded companies, companies with annual gross receipts exceeding $5 million that have more than 20 full-time U.S. employees and a physical office in the United States, and companies already subject to Federal government oversight (e.g., banks).

What is a Contract: Part 4: Representations, Warranties, Covenants - The Bones of the Agreement.

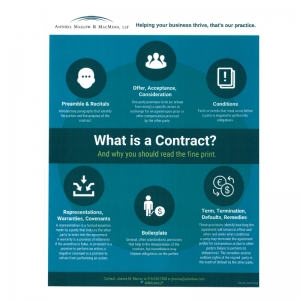

This is the fourth installment of my continuing blog series explaining the main elements of a contract, which are outlined on the attached infographic . My goal is to demystify some of these basic provisions to help business owners have a better general understanding of what they are signing.

This article discusses representations, warranties, and covenants, which are the “bones” of the parties’ agreement. These provisions represent the statements of the underlying facts, mutual assurances, and promises of performance which form the basis of the parties’ mutual understanding. It’s not uncommon to find these concepts used interchangeably in a contract – “ABC represents, warrants, and covenants…”, but the meaning and effect of each of these are quite distinct from one another. It’s important to understand these distinctions so that your contracts accurately reflect the assumptions, obligations, and risks that you are comfortable with.

A representation is a statement of past or present fact (either express or implied) made by one party to induce the other party to enter into the agreement. For example, the seller of a business might represent that gross revenues from the business were a certain dollar amount for the past several years or that there are no claims asserted against the business. If a representation proves to have been untrue when made, the injured party will have a claim of fraudulent misrepresentation if she can prove that: (i) the party making the representation knew or should have known the statement was false when made; (ii) the other party intended the injured party to rely on the statement; and (iii) the injured party’s reliance on the statement in entering into the agreement was justifiable. The injured party can seek monetary damages for its losses or it may ask the court to rescind (void) the entire contract. It is therefore very important to avoid “over-representing” in your contracts.

A warranty is essentially a promise that an assertion made by a party is true, coupled with an implied promise of indemnity if the assertion made by the party is false. As such, a warranty is both present-focused, like a representation, and forward-looking, like a covenant. If a warranty is breached, the injured party is entitled to be made whole; this usually means that the injured party can recover the difference between the value of the contract as agreed upon and the value of the contract in light of the breach. In other words, the injured party is entitled to receive the benefit of the bargain he initially made. The injured party is not required to demonstrate that he relied on the warranty or that the other party knew that the warranty was false when made.

Often, but not always, representations and warranties go hand-in-hand to allow the parties to preserve remedies that are as broad as possible. In complex agreements, the parties usually spend a significant amount of time negotiating how the risks embodied by representations and warranties should be allocated by qualifying and limiting these concepts (e.g., a representation is true to the best of the maker’s knowledge and/or in all material respects).

Product and service warranties are specialized contractual provisions that are actually hybrids of representations, warranties, and covenants. These provisions commonly create limited express warranties that apply to the products or services, identify specific contractual remedies for breach, and disclaim implied warranties that are provided by law.

A covenant is a party’s promise to perform an action or to refrain from performing an action. It relates to the future, as opposed to representations, which are provided as of a specific date. An example of a covenant is a borrower’s promise to make loan payments in accordance with the terms of a promissory note. Covenants can be express or implied. Pennsylvania law imposes an implied covenant of good faith and fair dealing in most contracts.

Stay tuned for Part 5 of this series, which will move on to discuss some possible hidden perils of what is commonly dismissed as “just boilerplate” language.

What is a Contract: Part 3: Conditions - When Is a Promise No Longer a Promise?

This post continues my series explaining the main elements of a contract, which are outlined on the attached infographic. My goal is to demystify some of these basic provisions to help business owners have a better general understanding of what they are signing.

Another key element of a typical contract is a condition. A condition is an event that must occur or a fact that must be true before a party is obligated to perform his obligations under a contract. Conditions are used to allocate risk by making a party’s obligations, which would otherwise be absolute, dependent on circumstances that are usually outside of that party’s control. The risk of those circumstances not occurring is thus shifted to the other party. For example, your agreement to buy a parcel of real estate might be conditioned on your ability to obtain financing. If you are unable to get financing, you are not obligated to proceed with the sale. Your failure to perform your obligations is excused and is not a breach; the seller will have no claim for damages against you based on your failure to perform. A condition is not necessarily tied to a third party’s performance of an action (such as a bank agreeing to lend money to the buyer) but is sometimes linked to the performance of an obligation by the other party. Some conditions are dependent on weather or similar events that are altogether outside of the contracting parties’ and third parties’ control.

Sometimes a condition is drafted so that its non-fulfillment excuses some, but not all, of a party’s obligations under the agreement. As a result, if the condition is not met, the agreement remains in force as to all other obligations. On the other hand, a condition may be drafted so that the entire agreement will terminate if the condition is not satisfied (such as the property sale example above). It is important to note that the party benefitting from the condition may choose to waive the condition and proceed with performance under the agreement. Further, if the party whose obligations are conditioned performs those obligations even though the condition has not been satisfied, he may be deemed to have waived the condition.

Conditions are not necessarily identified in a single specific section of a contract, but often are sprinkled throughout the agreement where the parties’ obligations are identified. Because of the impact of an unsatisfied condition, it is important to be able to recognize conditions on the other party’s obligations before you enter into the agreement. Look for words such as “if”, “provided that”, “in the event that”, “subject to”, “on the condition that”, “conditioned on”, and “contingent on”.

Before you sign any contract, you should be sure to assess whether any of your obligations should be conditioned on the occurrence of facts or events. If so, it is important that those conditions be clearly identified. Similarly, you should review the agreement to identify any conditions to the other party’s obligations and their impact on the agreement overall and your rights under the agreement. Ask yourself:

• Does the agreement set out unrealistic, vague or unpredictable conditions under which the other party could be released from its contractual obligations to me? Will I have incurred unnecessary expenses prior to the determination whether the condition has been satisfied (e.g., purchase of supplies or services)?

What impact will a release of the other party’s obligations have on my business (e.g., finding a substitute vendor)?

• What actions or omissions (by me or key staff) could result in a release of the other parties’ contractual obligations?

• Are any conditions on my performance needed to provide a way out in the case of prohibitive or unacceptable changes in circumstances down the line?

In summary, contractual agreements will ultimately only yield the intended benefits to your business if they are enforceable, and that means understanding under what conditions some or all of the other party’s obligations might be excused.

Stay tuned for Part 4 of this series, which will move on to the next contract element shown on the infographic: Representations, Warranties, and Covenants.

No Hire Clause Called into Question

Many companies use restrictive covenant agreements with key employees to guard against economic harm to the company by an employee who takes a job with the company’s competitor and/or tries to persuade the company’s customers to stop doing business with the company. These are particularly common with sales staff. In Pennsylvania, these covenants will generally be upheld if they are narrowly drawn to protect the employer’s legitimate business interests and if the employee has been given meaningful consideration in exchange for agreeing to be bound by the covenants. To learn more about Noncompetes, visit our Navigating Noncompetes blog series in the AMM Employment Law Blog.

Companies recognize that merely doing business with other firms can also be risky when it comes to protecting their interests in employees and customers. Consequently, it has become customary to include “no hire” provisions in contracts to prohibit a party from hiring away the other party’s staff. These clauses are particularly common in agreements in the technology field and in non-disclosure agreements that parties often enter into when evaluating whether or not to begin a business relationship. The viability of these provisions is in doubt in Pennsylvania, where the Pennsylvania Superior Court struck down a no-hire clause in a service agreement earlier this year. The Pennsylvania Supreme Court has agreed to hear the case.

In Pittsburgh Logistics Systems, Inc. v. BeeMac Trucking, LLC, the trial court held that the no-hire clause was unenforceable because it prevented individuals from seeking employment with certain companies even though those individuals had not agreed to or been compensated for the restriction. It is important to note that in a separate action, Pittsburgh Logistics Systems (“PLS”), the company attempting to enforce the restrictions against BeeMac, was unsuccessful in its efforts to enforce the restrictive covenants contained in four employees’ employment agreements, each of whom left to work at BeeMac. The trial court concluded that the covenant not to compete was oppressive and overly broad since it had an unlimited geographic scope. The court viewed PLS as having “unclean hands” and refused to enforce the restriction at all.

The Superior Court agreed with the trial court and held that the no-hire clause was unenforceable as a matter of law. The Superior Court was influenced by the lower court’s holding that the non-compete covenants in the employment agreements were not enforceable, noting that it would be unfair for PLS to achieve the same result by using a contractual no-hire provision in its contracts with other companies.

Two Superior Court judges dissented, drawing a distinction between a no-hire provision in a contract between two companies and a non-compete clause binding employees. They reasoned that the no-hire clause did not restrict the employees’ actions; rather, the clause was a bargained-for restriction in recognition of the fact that BeeMac would have access to PLS employees and know-how. The dissenting opinion suggests that the correct analysis is whether the no-hire clause was a reasonable restraint on trade. Using that test, the dissenting judges would have enforced the clause and granted the injunctive relief requested by PLS to prevent BeeMac from “enjoy[ing] the benefit of its purported breach” and “leverag[ing] the specialized knowledge that PLS’s former employees acquired while under its employment.”

It will be interesting to see how the Pennsylvania Supreme Court views these issues when it hears this case. Stay tuned for further developments.

What is a contract: Part 2: Offer, Acceptance, Consideration: What’s in it for you?

This post continues my series explaining the main elements of a contract, which are outlined on the attached infographic. My goal is to demystify some of these basic provisions to help business owners have a better general understanding of what they are signing.

Moving through the structure of a typical contract, next up is offer, acceptance, and consideration. Together, these clauses define what the offering party is promising to do (or refrain from doing) in exchange for the compensation the other party is willing to pay or provide. They basically comprise the tit for tat, or the meat of the obligations and privileges which are being offered. This is often referred to as a “meeting of the minds.” While this might seem obvious on its face, the devil may be in these details, so it is vital that you know and understand the specific nature of your obligations and be sure that they are sustainable, practical, and likely to result in a benefit to your bottom line or some other benefit to your business. So what can happen when parties fail to clearly memorialize their “meeting of the minds”? Here are a few scenarios that could result:

• The parties might become embroiled in a “battle of the forms”, particularly in the sale of goods context where a buyer submits a purchase order using their company’s form, and the seller responds using their own terms and conditions form containing different and/or additional terms.

• Parties can ask the court to apply certain legal theories to supplement the “four corners of the document” where the intent of the parties may not be clear from the contract itself. For example, even if there is no formal consideration, courts can apply the theory of promissory estoppel to enforce a party’s promise to do something if the other party relied on that promise to his or her detriment.

• Another equitable remedy allows the court to compel a party to make restitution if that party is enriched at the expense of the other party and the surrounding circumstances lead the court to conclude that it is unjust.

• Pennsylvania has a little-known statute called the Uniform Written Obligations Act, which allows the court to infer that consideration exists where the agreement includes language that clearly and expressly states that the parties intended to be legally bound by the agreement.

Stay tuned for Part 3 of this series, which will move to the next element on the infographic: Conditions.

Visit ammlaw.com to learn more about our contract review services, or Joanne Murray.

What is a Contract: Preamble/ Recitals - Let’s begin at the beginning

This post continues my series aimed at explaining the main elements of a contract. These elements are outlined on the attached infographic. My goal is to define the key elements of a contract and to offer some tips and cautions to avoid costly mistakes as you approach these essential documents in your day-to-day business operations.

First up: the preamble and recital sections. The preamble of a contract is the introductory paragraph that identifies the parties to the agreement. It is typically followed by paragraphs known as recitals (also called the background section). Sometimes, these recital paragraphs are labeled “Whereas”. Taken together, the preamble and the recitals tell the who, what, when, and why of the transaction. In other words, they should tell the reader who the parties to the agreement are, the date of the agreement, and what the parties hope to accomplish by entering into the agreement.

As with stories told in other settings, inaccuracies and ambiguities in the preamble and recitals of a contract can cause problems down the road. One of the underlying purposes of a contract is to set forth the agreement of the parties so that their expectations can be enforced by a court or other tribunal. An accurate and detailed introduction to the contract can educate the person who is charged with resolving the dispute as to who the parties are, why they entered into the contract, and what their expectations were at the time the agreement was entered into.

One of the most common mistakes in these preliminary sections of a contract is to incorrectly name the owner of the business as a party, rather than using the entity name. This mistake results in the owner being personally obligated as a party to the contract, which is clearly not the result an owner expects after taking the trouble to incorporate.

While it may be tempting to gloss over these preliminaries without questioning their accuracy, I highly recommend taking the time to carefully review this section in every contract to be sure the story it tells is true and complete. It could prevent costly conflicts later.

Stay tuned for Part 2 of this series, which will move to the next element on the infographic: offer, acceptance, and consideration.

What is a Contract, and Why You Should Read the Fine Print

As a business owner, you are routinely asked to “sign on the dotted line.” The document could be a purchase order, an equipment lease, or a bill of sale. Often, these documents are in fact contracts that impose obligations on the parties, even if they don’t say “Contract” or “Agreement” at the top of page one. I can’t overstate the importance of knowing what you are signing – i.e., being able to recognize a contract when you see one, as well as understanding the components of a contract and how they impact your business. I often say “think before you sign; review before you renew.”

Over the years, I have worked with many business owners who discover a little too late that they have signed a document that does not align with their intentions and may have costly consequences. For this reason, and under the theory that knowledge is power, I have put together the attached infographic to try to demystify and define the essential elements of a contract. In the coming weeks, I will be writing a series of informational blogs on each of the identified sections of this schematic to offer guidance for business owners as they approach the documents which are so essential to the health and profitability of their enterprise.

Legislative Updates Owners of PA LLC’s & Partnerships Need to Know – Part 2

Earlier this year, amendments to Pennsylvania’s statutes governing partnerships and limited liability companies (often referred to as unincorporated entities or alternative entities) went into effect. I recently blogged about the “transferable interest” concept adopted by the Act. Today, in Part 2 of this series, I highlight another significant change brought about by Act 170: the clarification of the fiduciary and other duties owed in the context of an unincorporated entity. In general, there are three basic duties:

• Duty of loyalty: generally, a duty to avoid self-dealing, competing and usurping company or partnership opportunities

• Duty of care: a duty to refrain from gross negligence and recklessness

• Duty of good faith and fair dealing: a duty to deal fairly and consistently with the terms of the parties’ agreement and the purpose of the entity

In a general partnership, each partner owes the above duties to each of the other partners and to the entity.

In a limited partnership: (a) the general partner owes each of these duties to the limited partners and to the partnership; and (b) the limited partners owe only a duty of good faith and fair dealing to each other.

In a manager-managed LLC: (a) the manager owes these duties to the members and to the entity; and (b) the members owe a duty of good faith and fair dealing to each other. In a member-managed LLC, the members owe these duties to each other and the company.

Some of these duties may be modified by agreement of the parties. In their operating or partnership agreement, the parties may modify, but not eliminate, the duty of loyalty and the duty of care, as long as the modification is not “manifestly unreasonable.” This standard is not defined and is left to the courts to interpret, but in general the agreement cannot convert the relationship into a strictly arm’s length relationship. The duty of good faith and fair dealing may not be modified or removed, but the owners’ agreement can identify the standards by which this duty will be measured.

Legislative Updates Owners of PA LLC’s & Partnerships Need to Know – Part 1

The Pennsylvania General Assembly, with significant input from the Pennsylvania Bar Association’s Business Law Section, recently passed Act 170, which overhauls the statutes governing partnerships and limited liability companies (often referred to as unincorporated entities or alternative entities). This Act brings these statutes up to date with the uniform laws on which they are based and is now in effect for all new and all existing unincorporated entities. These comprehensive amendments provide default rules for governance and other matters that fill the gaps in the absence of an operating agreement or partnership agreement (or the absence of applicable provisions in those documents). Accordingly, it is important for owners of partnerships and LLCs to review their governing documents and be sure they have a clear understanding of how these new rules apply to them. Owners should work with counsel to draft provisions to vary these default rules if that is the desired outcome.

One significant change brought about by the Act is the recognition that equity interests in unincorporated entities are bifurcated into governance rights (including consent, management, and information rights) and economic rights (i.e., the right to receive distributions). The amendments adopt a concept called a “transferable interest”, which is an interest in the partnership or LLC that includes only economic rights. The holder of a transferable interest has no governance rights; he or she has only the right to receive distributions from the entity (but not the right to demand or sue for distributions). The transferable interest approach honors the “pick your partner” principle, which assures owners of a business entity that they will be able to choose the co-owners of the enterprise. Under the revised statute, the only interest that can be conveyed to a non-member is a transferable interest, unless the operating agreement provides otherwise or the other owners expressly agree. Thus, a creditor foreclosing on a member’s equity interest or a person seeking to attach a spouse’s equity interest in a divorce proceeding can take only a transferable interest. This limitation on the rights of non-members affords owners important protections from assertions of control by outsiders which may not be in the best interest of the entity or its members. The exception to this rule is that a creditor foreclosing on an equity interest in a single-member LLC will take the full membership interest (governance and economic rights). The rationale for this exception is that because there is only one member, the “pick your partner” rationale does not apply to limit the rights of the lender.