![]()

Collaborative approach with clients' working group

![]()

Practical, cost-efficient solutions to complex legal issues

![]()

Accessibility and responsiveness unique to suburban practice

![]()

Relationship-driven

client service

Software Licensing

Computer technology, software and systems are vital to businesses of all sizes. Antheil Maslow & MacMinn attorneys have extensive experience representing software vendors, computer consultants and other provider-side parties of the technology equation, as well as customers in the industry. We are also familiar with the unique issues facing software developers, including the use of open source software and trade secret protection.

From negotiating and drafting contracts for development through complex litigation relating to failed software and systems development projects, our Business & Finance Practice Group helps clients in the Greater Philadelphia area including Bucks County and Montgomery County reap the advantages of regulations, policies and the commercial environment affecting the way they do business. Our work includes drafting and reviewing all types of technology-related contracts, including:

- Non-disclosure Agreements

- License Agreements

- Support and Maintenance Contracts

- Consulting Work for Hire Agreements

- Joint Development and Marketing Relationships

- Website Development Agreements

- Source Code Escrow Arrangements

Banking

Banking law covers a wide variety of topics relating to the regulation of banks, bank officials, and non-bank institutions that offer bank services. Antheil Maslow & MacMinn’s Business & Finance Practice Group attorneys understand the challenges financial institutions face on a daily basis.

From simple loan documents to complex land development deals, Antheil, Maslow & MacMinn attorneys help in balancing the need to make intelligent lending decisions with the desire to establish and maintain strong customer relationships. We understand the needs of a company and the requirements of lenders, bringing a depth of experience to the legal needs of the Greater Philadelphia area including Bucks County and Montgomery County for the following services:

- Documentation for loan workouts, receiverships, assignments, restructuring/reorganizations, repossessions, bankruptcies and foreclosures

- Negotiable instruments (e.g., bill of exchange, promissory note)

- Commercial asset-based and unsecured financing

- Real estate secured and unsecured financing

- Construction financing

- Commercial leasing

- Sales of loan and lease portfolios

- Creditor’s rights

- Defense of Fair Credit Reporting Act claims

- Defense of lender liability claims

- Defense of Fair Debt Collection Practices Act claims

Overview: Business & Finance

For more information about our Business & Finance services, contact:

- Lisa A. Bothwell

- Janel Clause

- Susan A. Maslow

- Michael W. Mills

- Joanne M. Murray

- Peter J. Smith

- Stephen M. Zaffuto

As companies grow, so does their need to manage financial, legal and operational challenges. Creating sustainable growth requires hard work, planning and a sound stragety, this is where AMM's business team can help.

Our business clients range from high-growth, early-stage companies and regional community banks to mature, closely-held manufacturing and licensing enterprises, as well as service companies and health care providers. We create long-term relationships with our clients as they rely on our integrity, capabilities and responsiveness to their questions and concerns. Our legal team anticipates the needs of clients as those needs evolve over the life cycle of the business.

Our Practice Focus:

- Mergers & Acquisitions

- Business Divorce

- Contract/Drafting & Review

- Corporate Governance

- Corporate Record Keeping

- Entity Formation

- Financing

- Private Placement of Securities

- Software & Saas Licensing Agreements

- Employment, Shareholder, Partnership & LLC Operating Agreements

- Real Estate Purchases & Leases

- Succession Planning

- Executive Compensation, Including Equity Compensation & Alternatives

Industries Served:

- Manufacturing & Industrial

- Professional Service Providers, Including Accounting, Legal, Engineering,

Medical & Financial Advisory Services - Biotech & Pharma

- Technology/Software

- Real Estate Developers

- Nonprofit Organizations

- Restaurants & Hospitality

- Healthcare Providers

Mergers & Acquisitions

Complex Mergers and Acquisitions:

Few matters are more complex or have greater importance to our business clients than mergers and acquisitions. AMM attorneys are experienced in developing and implementing creative strategies to position our clients, helping to maximize value whether they are a buyer, a seller, a lender, or an intermediary. Our attorneys are highly skilled deal makers with the knowledge and insight to guide you through the twists and turns and complexity of a high stakes business merger or acquisition.

Working closely with businesses of all sizes, from small entrepreneurial companies to mature entities, our team crafts custom solutions for every facet of your transaction. We take the time to understand your strategic objectives and bring years of practical business savvy to bear to ensure that the finance, tax, employment and intellectual property requirements of your deal are aligned to achieve your goals.

Our seasoned business attorneys regularly provide counsel in planning, structuring, negotiating, and consummating a varied range of relationships and transactions including:

• Transaction structuring

• Negotiating and preparing non-disclosure agreements and letters of intent

• Due diligence

• Negotiation of financing documents

• Negotiation and development of definitive agreements

• Assistance with post-closing matters, including earn-out, working capital, escrow, and seller financing issues

Our business clients know that their attorney is a dedicated partner who understands their needs, goals, and the stakes involved in this meaningful phase of the life cycle and evolution of their businesses.

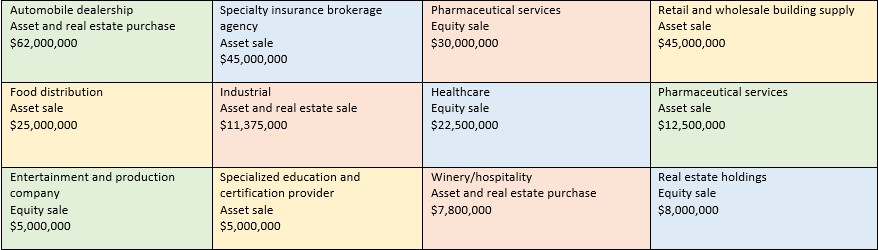

Representative Deals:

Personal Injury FAQS

I’ve been injured. How do I know if I have a claim?

We’ve all heard or read articles about our “lawsuit happy” culture. The fact is that persons injured have had the right to bring a claim for compensation since colonial times. The law has evolved since then, but the fundamental principal that a party injured by someone else’s carelessness has a legal right to be made whole hasn’t.

How do you know if you have a case?

Only a qualified and experienced personal injury attorney can evaluate the specific facts of your case and determine whether a case can successfully be brought. Our attorneys have successfully represented hundreds of clients who have been injured in motor vehicle accidents, slip and fall accidents, sports related accidents, dog bite incidents, and injuries which resulted from dangerous and defective products.

How long do I have to sue?

You might be familiar with the term “statute of limitations”. Each state sets time limits within which claims must be brought. In Pennsylvania and New Jersey, the time limit applicable to claims for injuries is two years. Failure to file within that two year time period will result in a claim being permanently time barred.

Can I still win a personal injury claim, even though I was partially at fault?

Yes. In Pennsylvania, so long as you are not more than 50% at fault, you can still be compensated for your injuries. Your compensation is reduced by the percentage of fault attributed to you. As an example, assume you are injured in a car accident and the jury finds that you should be awarded damages in the amount of $100,000. If the jury also finds that you were partially at fault for the accident, say 30%, the damage award will be reduced by 30%. In this example, you would recover $70,000 ($100,000 - $30,000).

If I was injured on the job, can I still file a personal injury claim?

If you were injured on the job, in addition to filing a Workers’ Compensation claim, you can also file a personal injury claim if a party other than your employer was at fault for your injuries. For example, imagine you are injured when, while operating a punch press, the mechanism activates while your fingers are in the way. You may not bring a claim against your employer, but you may bring a claim against the manufacturer of the punch press if your injury resulted from a defect in its design or manufacture. Another example: Suppose you are a salesperson and you spend a lot of time in your car traveling from sales call to sales call. On the way from one call to the next, your vehicle is struck in the rear by a negligent driver. You can file a personal injury claim against that negligent driver. In each of these examples, as an employee acting within the scope of your employment, you can be compensated for your injuries through Workers’ Compensation and also file a personal injury claim against the party at fault for your injuries.

What is consortium?

The law recognizes that when one spouse is physically injured, the non-injured spouse is also affected. These effects range from intimate relationships to changes in personality making the injured spouse grumpy; testy; short-tempered; to extra work imposed on the non-injured spouse because his or her partner is no longer able to help with the children, the household chores, or maintenance.

Who pays for my medical bills in a personal injury case?

If you were injured as a result of an automobile accident, your own automobile insurance carrier pays for your medical bills up to the limits under your policy. After your automobile insurance policy limits have been exhausted, any remaining medical bills are paid by your private health insurance carrier. If you qualify for Medicare or Medicaid, those programs also pay for medical expenses after any applicable insurance under your automobile policy is exhausted.

If you were injured in an accident other than an automobile accident, your medical bills are paid by your private health insurance carrier or Medicare or Medicaid as applicable.

Is there an obligation to reimburse my insurance carriers for the medical bills they pay for my treatment?

Yes, depending upon which insurance carrier pays.

If you were injured as a result of an automobile accident, and your bills are paid by your automobile insurance policy, there is no repayment obligation. If your private health insurance carrier paid some or all of the bills, there may be a repayment obligation depending upon whether you are a participant in a group plan offered through your employer. If Medicare, Medicaid or Workers’ Compensation paid any portion of the medical bills, they must be reimbursed.

If your injuries are not the result of a motor vehicle accident, you are obligated to reimburse your private health insurance carrier, Medicare, Medicaid and Workers’ Compensation, if any of your expenses are paid by them.

Keep in mind, however, that the amount you are obligated to pay in reimbursement is a part of the claim presented against the negligent party. A damages award will include these amounts, as well as compensation due to you for any out of pocket loss you sustain (such as co-pays and deductibles), any lost wages and the pain, suffering and trauma you’ve suffered.

Overview: Personal Injury

"Bucks County's Personal Injury Law Firm"

For a free initial consultation with an experienced Bucks County personal injury lawyer, contact:

When you have been harmed, physically, emotionally and economically by the carelessness of another, you need attorneys who can help. At Antheil Maslow & MacMinn, our attorneys have been helping injured clients for over twenty years. If you have been seriously injured or have lost a family member as the result of someone else's fault, we'll guide you through the case, from the insurance claim to the trial, explaining the process at each step of the way. We clearly communicate, to a claims representative, arbitrator, mediator or judge and jury, the losses you have suffered.

Convenient to you in Bucks and Montgomery Counties; AMM Attorneys offer aggressive representation anywhere in Pennsylvania and New Jersey. The aftermath of an accident can be overwhelming. Insurance companies may be contacting you. You may be unable to work and need income. Medical bills are looming and you are dealing with daily pain. There's never been a more important time for you to seek professional help. We're here to guide you.

As committed and passionate advocates on your behalf, our legal team begins helping right away by dealing with your health or auto insurance company to pay medical bills, recover lost wages and repair damaged property. You'll have questions ... we'll provide answers. There will be problems ... we'll get them solved.

Let our Personal Injury Practice Group help you: We've recovered for injuries from:

- Defective or Malfunctioning Products

- Falls Due to Hazardous Conditions of Real Estate

- Motor Vehicle Accidents

- Motorcycle and ATV Accidents

Here are some of our success stories:

Community Resources

Antheil Maslow & MacMinn is committed to the larger community and we encourage members of our Firm to participate in civic work, both as part of the programs we carry out together, and on an individual basis in our everyday lives. Many of our attorneys actively serve and support various civic, charitable and youth activities in the Bucks County area.

Doylestown/Local Interest

Bucks County Conference and Visitors Bureau

Bucks County Court Rules

Bucks County Government Home Page

Bucks County: restaurants, real estate, events, classified, etc.

Bucks County Taxes

Central Bucks Chamber of Commerce

Chalfont Borough

Doylestown Alive

Doylestown Borough

Doylestown Township

New Britain Borough

Intelligencer Record

More...

Frequently Asked Questions

The materials contained on this Web site are designed to enable you to learn more about the services that Antheil Maslow & MacMinn, LLP ("the Firm") offers to its clients. This Web site and the materials provided are not legal advice and you may not rely on them as such. While the Firm may welcome the opportunity to provide legal services, your use of this Web site does not create an attorney-client relationship and communication with the Firm may not be subject to the attorney client privilege. As with any legal problem, you should always seek the advice of competent legal counsel in your own state.

Labor & Employment

How do I determine whether to classify my workers as employees or independent contractors?

The classification of a worker as an employee or independent contractor will depend upon the legal context. The most critical legal contexts for small businesses generally include federal employment taxation (FICA and FUTA), federal discrimination laws (Title VII, ADA, and ADEA), the Fair Labor Standards Act, the Employees Retirement Income and Security Act, and state workers' compensation acts. Certain industries, such as health care, may have further issues relating to the classification of workers.

Each context brings its own classification analysis, and in each context the standards for classification are highly subjective, and will depend upon facts and circumstances. A common thread among the contextual analyses is the ability of the employer to control the worker's duties, time of work, etc. (so-called "right to control"). There are no hard and fast answers to the classification question, and it is recommended that employers perform an analysis through legal counsel to document the basis for the determination, which takes into account the particular context.

Does my business need an employee manual or handbook?

In Pennsylvania, employers with as few as four employees are subject to the Pennsylvania Human Relations Act, which prohibits discriminatory and harassing treatment of employees based on gender, race, age or disability. The federal laws prohibiting such conduct apply to employers with as few as fifteen employees. Both the state and federal laws create a defense to certain types of discrimination and harassment claims if the employer has in place a procedure for making complaints about such conduct that has been distributed to employees.

Having policies and procedures published in a manual or handbook for the most common employment issues will save time and money, and prevent any claims of unfairness. If your employee handbook is prepared by a lawyer, you will have the added reassurance of knowing that your responses to these issues are consistent with the variety of federal and state laws that affect the employment relationship. Your employee handbook will allow you to avoid waste of time or resources, and will ensure fair treatment of valuable employees. This is true regardless of the size of the employer.

Tax

What is the difference between a corporation and an LLC?

There are a number of differences between a corporation and an LLC. There are also several different types of corporations. The differences affect how the company is taxed, how it operates, who can be a shareholder and a variety of other factors that are specific to each business. We would be happy to talk with you to discuss these differences as they relate to your business and help you decide what form your company should take.

What is a buy-sell agreement?

A "buy-sell" agreement is the name given to the document that is intended to set forth the exit plan for shareholders or partners. A well written document will provide specific direction for an equity holder who needs to disentangle him or herself long before the only options are retirement, bankruptcy or an expensive business divorce.

The document will determine: if the exit or decision to cease operations has to be unanimous; if a purchase by co-shareholder or co-partner is required; how long a disabled shareholder or partner has to be carried; if a spouse or other family member can inherit an equity interest in the event of death of a shareholder or partner; and, if a transfer of equity to a third party is permitted without the consent of the surviving shareholder or partner. The decision to exit, or need to see your co-shareholder or co-partner exit, may not be voluntarily. If discussed and planned before the fact, it doesn't also have to be messy.